Maximizing the Legal Ways

Buying rental real estate sounds exciting, right? Cashflow, appreciation, and long-term wealth creation are all the things that attract investors to this amazing asset class.

One of the many advantages to rental real estate is the tax benefits that flow thru to investors.

Most of us don’t really love handing over our hard-earned money to Uncle Sam, so understanding all the tax laws and learning how to leverage the legal ways to push off taxes as long as possible, will help you avoid paying more in taxes than necessary.

A key element in the tax code that many investors get excited about is the 1031 exchange.

Normally when someone buys a rental property and is ready to sell it, an investor must be prepared to pay taxes on any of the gains made from the property. But the 1031 exchange is a popular and legal way many investors use to defer those gains.

What is a 1031 EXCHANGE?

This refers to section 1031 in the IRS tax code that allows investors to sell investment real estate, then buy replacement “like-kind” property with little to no tax liability resulting from the gain.

There are obviously some rules to follow in order to properly defer the payment of the tax on the gain, but it is one of the most powerful tax strategies many real estate investors take advantage of.

A common question we get is can I roll 1031 funds into a syndication?

Investing in apartment syndications has become a very popular way for real estate investors to invest in bigger assets, gain the economy of scale that comes with apartments, and grow their passive income.

There is a common misperception that you cannot do a 1031 exchange directly into a syndication.

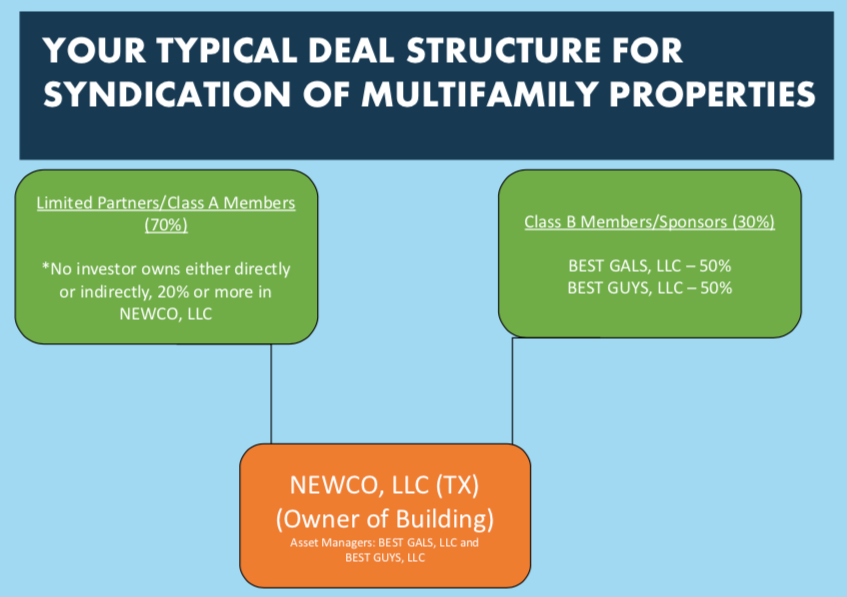

This is mainly attributed to the fact that when you invest in a multifamily syndication, you are typically purchasing part of an entity (shares) that actually owns the property, not the property itself.

So can I invest in an apartment syndication using a 1031 exchange?

The answer is YES!

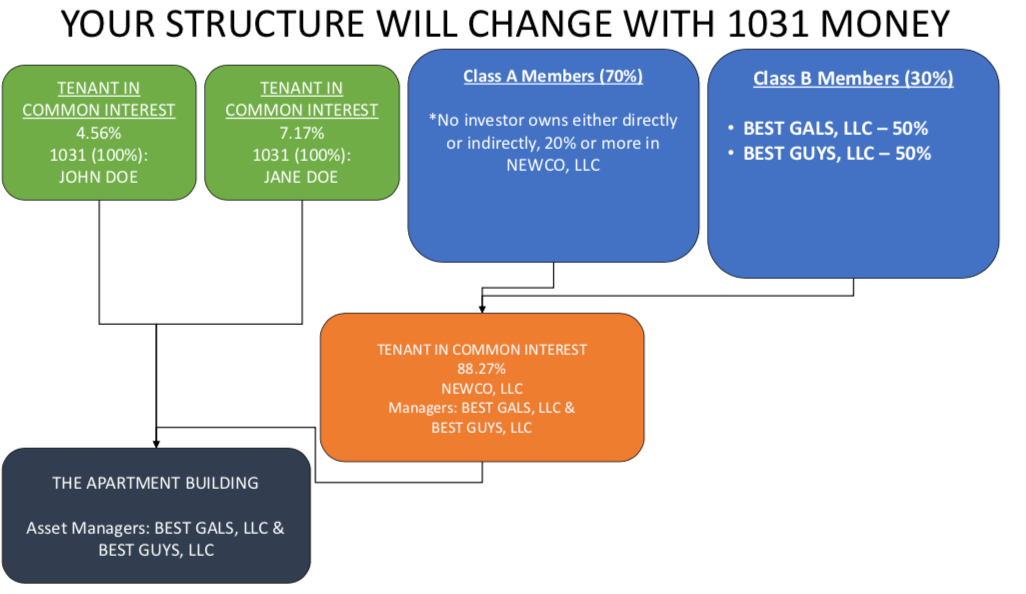

This can be achieved through a structure called Tenants in Common…aka TIC (No not the bug!).

There are obviously a lot of details and best practices in order to efficiently and legally pull this structure off. That’s why having an experienced legal professional on your team is critical.

Our go-to attorney is Dugan Kelley of Kelley Clarke PLLC. He is hands down the best in the biz and we can’t recommend him enough.

You can find his office and contact info here:

Dugan Kelley

Kelley Clarke PLLC

301 South Coleman

Street Suite 20

Prosper, Texas 75078

P: 972-253-4440

[email protected]

Subscribe to his channel, he’s got some amazing content!

A 1031 Exchange can be leveraged by a Real Estate Investor who is selling a Rental Real Estate property and who wants to postpone paying taxes on the GAIN or money made from the property.

It is possible to use a 1031 Exchange into an Apartment Syndication, but you need to make sure you are following the proper “rules of engagement” to avoid any tax penalties or legal recourse.

We strongly advise using an experienced Attorney you can trust, who understands the 1031 tax law as well as SEC rules of real estate syndications. We cannot offer any higher recommendation for an SEC Attorney, than Dugan Kelley.

Here at Think Multifamily, we wish each and every one of you a successful experience investing for your family’s future. We are with you every step of the way.

For more info, contact [email protected]