Multifamily Financing for Beginners

Agency Lenders

Fannie Mae or Freddie Mac, commonly referred to as Agency debt, are two of the primary methods for financing stabilized, cash flowing apartments. Stabilized properties are typically described as having 90%+ occupancy for at least 3 months.

They offer some of the best loan products out there, including non-recourse options with low interest rates and longer payment terms.

One of the obstacles new investors face with financing agencies is that they prefer borrowers who have experience with ownership and/or management with apartments. This “chicken and egg” or “Catch 22” situation is why it’s important to find experienced partners to work with, especially if you’re new to the multifamily space.

HUD is another option that offers lower interest rates and even longer payment terms (35-year fixed rate). However, it can come with restrictions on distributions (every 6 months vs every 3 months) and have higher replacement reserves (extra funds you have to set aside for repairs). It is also a longer process to get this type of loan and will typically require more inspections/audits to deal with during ownership.

Traditional Banks / Bridge Lenders

This category of lenders are generally private institutions that make loans. They might be large banks, local community banks/credit unions, or large private lenders.

Some of the advantages to using this sort of financing is that they generally offer higher leverage than agencies and can close much faster. These types of loans are typically better for properties that are more “Fixer Uppers” – that need more physical rehab or maybe have low occupancy and/or low income. These institutions can be valuable partners on large value-add type projects.

On the downside, they can be more costly requiring additional points be paid or include higher closing costs. Additionally, they may be recourse loans (require personal guarantees from borrowers) and may require additional reserves be in place. Floating rates are also common in these types of loans, but rate caps can be purchased (lenders frequently require).

Finding the Right Financing

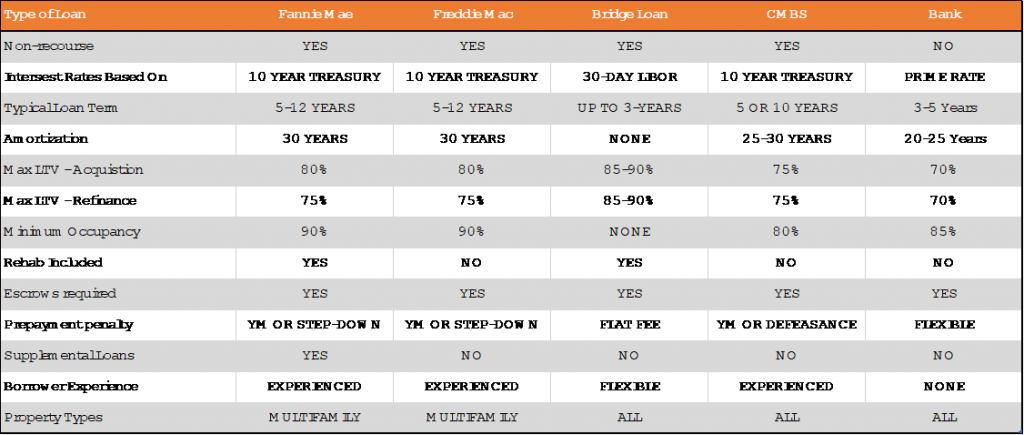

Below is a helpful chart that summarizes details of different financing options available for apartments:

Confused yet?

If it feels like you’re drinking water from a fire hose, that’s OK. There’s no need to memorize all the details.

This is why we recommend working with an experienced commercial loan broker who can help you navigate all these requirements and determine the best loan for your multifamily deal.

It is even more important in today’s Post-Covid 19 environment, as lenders have been adding and changing requirements frequently to meet the demands of the market.

Navigating the current lending environment by yourself is a minefield… You don’t want to be surprised when your financing will literally make or break your ability to purchase the deal.

In addition to helping you find the right lender and loan product, a good mortgage broker, who’s experienced in the multifamily space, will also help you to do the following: work through the execution process of the loan, help you put together all the documents required from you (the borrower), and be an advocate for you with the lender.

A good broker will be personable, easy to work with, and communicate well through the entire process. We have worked with many different lenders and brokers…and Brandi Shotwell with Reno Capital is one of the best. A great broker like her is worth her weight in gold with so many moving parts in these multifamily transactions.

To get more info on Commercial Real Estate Financing for your properties, contact Brandi today!

Brandi Shotwell

Reno Capital Management

5700 Tennyson Parkway, Suite #300

Plano, TX 75074

469.929.9538 Office

469.626.7979 Cell

For more information about Think Multifamily send your questions and comments to [email protected]